Published Friday, October 11, 2019 at: 7:00 AM EDT

Despite a 1.3% decline in September, the survey of small-business owner optimism, conducted and indexed by the National Federal of Independent Business monthly since 1986, remains high by historical standards. That's a strong positive fundamental amid a long list of uncertainties about the Federal Reserve's next move, trade war with China, pending impeachment of President Trump, European weakness, Brexit, and an inverted yield curve.

Of a sample of 5,000 small-business owners, the 603 usable responses returned showed a decline to 101.8, a 1.3% drop from August's reading of 103.1, according to the NFIB's release on Tuesday.

Small businesses create 60% of new jobs, and a recession is highly unlikely when business-owners are confident. Business owner sentiment impacts wage gains, investment, and jobs. In the long arc of its 42-year history, September's drop was nothing like the collapse in confidence preceding previous recessions.

"As small business owners continue to invest, expand, and try to hire, they're doing so with less gusto than they did earlier in the year, thanks to the mixed signals they're receiving from policymakers and politicians," said the NFIB's Juanita D. Duggan. "All indications are that owners are eager to do more, but they're uncertain about what the future holds and can't find workers to fill the jobs they have open."

One of the economic uncertainties clouding the future appeared to grow less threatening on Friday, when significant progress was reported in U.S. trade talks with China. The Standard & Poor's 500 index on Friday surged by 1.1% to close at 2,970.27, just 2% from its all-time closing high.

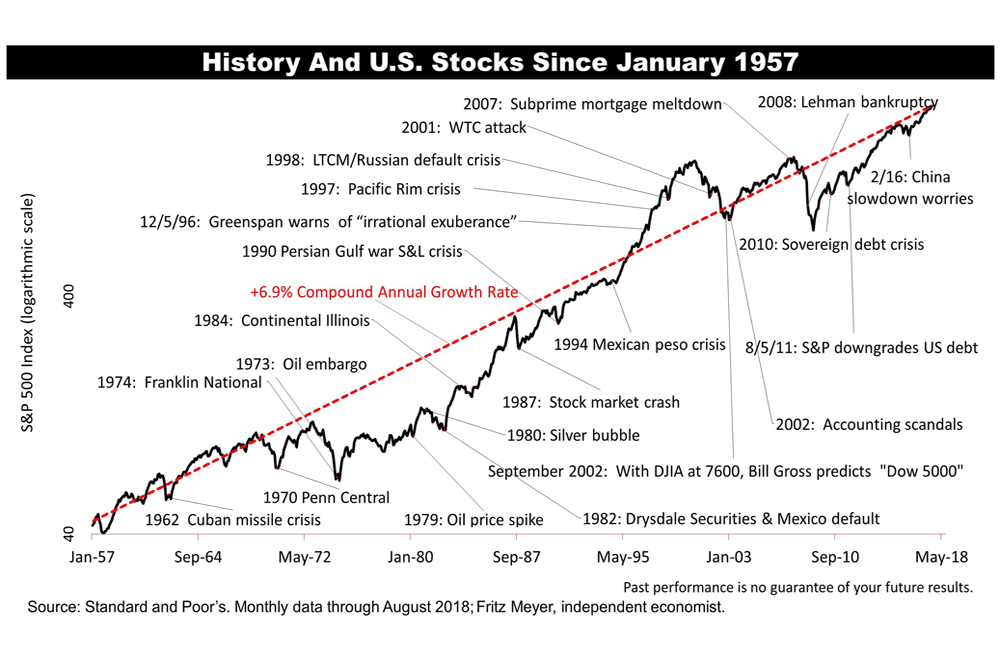

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

Despite Grim Headlines, Stocks Rose Sharply -- Why?

Despite Grim Headlines, Stocks Rose Sharply -- Why?

The Paradigm Shift In Valuing Stocks

The Paradigm Shift In Valuing Stocks

Retail Sales And Housing Starts In June Reveal Recovery's Shape

Retail Sales And Housing Starts In June Reveal Recovery's Shape

A Spectacular Year For Stocks

A Spectacular Year For Stocks

A Case For A Bull Market In 2020

A Case For A Bull Market In 2020

Good Economic News Again

Good Economic News Again

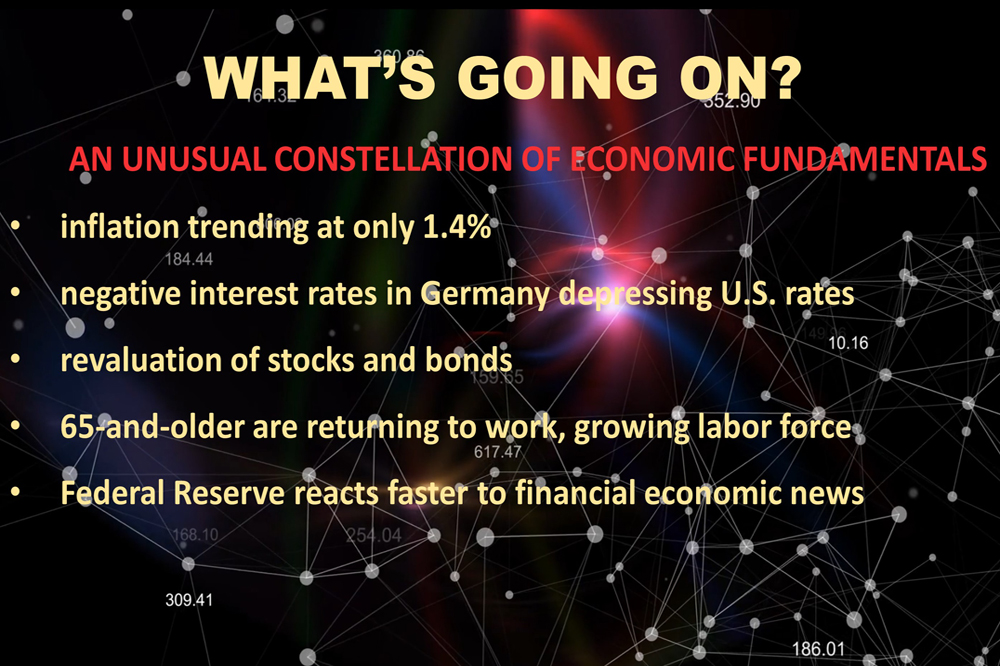

An Unusual Constellation Of Economic Surprises

An Unusual Constellation Of Economic Surprises

Longest U.S. Expansion Keeps Rolling

Longest U.S. Expansion Keeps Rolling

Retirement Income Reality Check

Retirement Income Reality Check

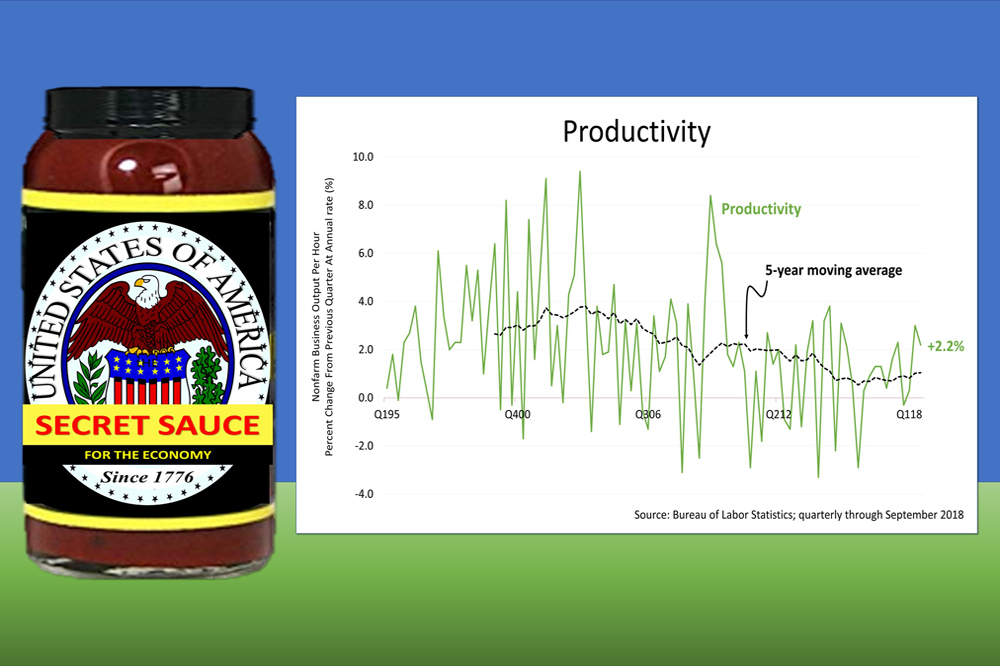

Find The Major Economic Trend Hidden In This Picture

Find The Major Economic Trend Hidden In This Picture

Is The New Record High In Stocks Irrational?

Is The New Record High In Stocks Irrational?

Stocks Break New Record; Economic Outlook Clears

Stocks Break New Record; Economic Outlook Clears

Despite Frights, Can The Expansion Continue?

Despite Frights, Can The Expansion Continue?

Retail Sales Coverage Reflected The Narrow View Of The Media

Retail Sales Coverage Reflected The Narrow View Of The Media

Small-Business Optimism Declines But Remains High

Small-Business Optimism Declines But Remains High

Analysis Of New Employment, Manufacturing & Service Economy Data

Analysis Of New Employment, Manufacturing & Service Economy Data

Quarter Ends Well Despite Trade War, Inverted Yield Curve & Political Crisis

Quarter Ends Well Despite Trade War, Inverted Yield Curve & Political Crisis

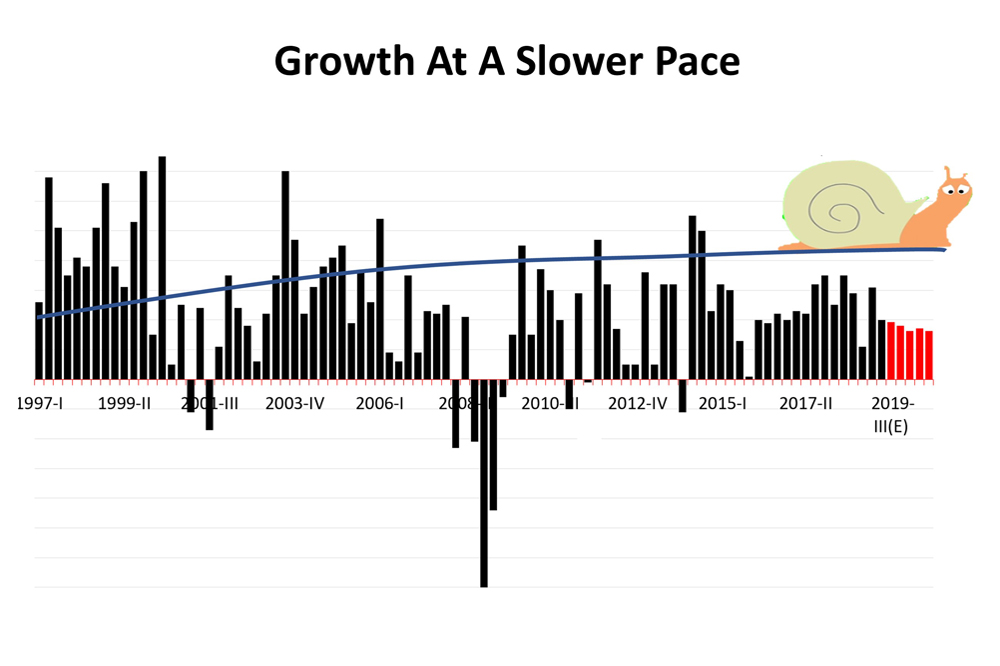

No Recession But A Slower Pace Of Growth

No Recession But A Slower Pace Of Growth

Fickle Financial Headlines Brighten

Fickle Financial Headlines Brighten

Economy Gets Bad Press Again

Economy Gets Bad Press Again

Europe's Growth Problem And Your Portfolio

Europe's Growth Problem And Your Portfolio

Stocks Dropped 2.6% On Friday, As Reality Gap Seemed To Widen

Stocks Dropped 2.6% On Friday, As Reality Gap Seemed To Widen

A Prudent Perspective On Recent Volatility

A Prudent Perspective On Recent Volatility

A Tale Of Two Economies

A Tale Of Two Economies

Amid Worries, New Equity Risk Premium Data Explained

Amid Worries, New Equity Risk Premium Data Explained

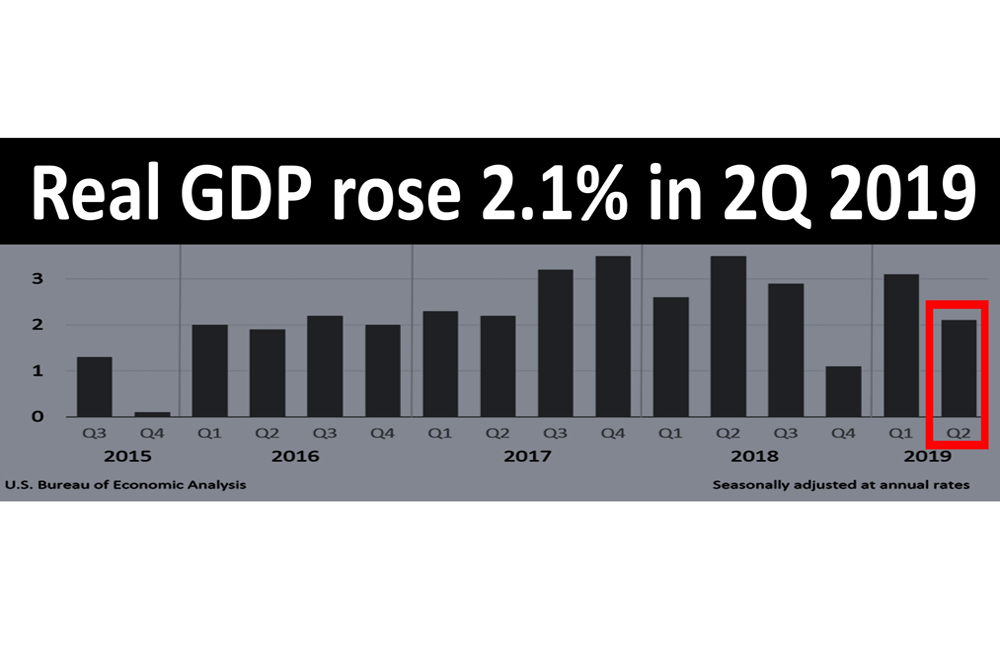

GDP Rose More Than Expected; Stocks Top Record Again

GDP Rose More Than Expected; Stocks Top Record Again

Slower Growth Confirmed By June Leading Economic Indicators

Slower Growth Confirmed By June Leading Economic Indicators

'Twas The Last Trading Day Before Christmas

'Twas The Last Trading Day Before Christmas

Stock Plunge Nears Bear Territory After Fed Hike

Stock Plunge Nears Bear Territory After Fed Hike

A Last-Minute Reminder To Give Wisely And Charitably

A Last-Minute Reminder To Give Wisely And Charitably

Key Facts About Tariffs, Interest Rates, And Economic Strength

Key Facts About Tariffs, Interest Rates, And Economic Strength

Fed Chair Extends A Dovish Hand, Lifting Stocks

Fed Chair Extends A Dovish Hand, Lifting Stocks

S&P 500 Slid Last Week, As Earnings Growth Is Recalibrated

S&P 500 Slid Last Week, As Earnings Growth Is Recalibrated

Last Chance For Pre-Retired Professionals & Biz Owners

Last Chance For Pre-Retired Professionals & Biz Owners

Amid A Swirl Of Controversy, Fed Policy Remained Stable

Amid A Swirl Of Controversy, Fed Policy Remained Stable

More Good Economic News On Friday

More Good Economic News On Friday

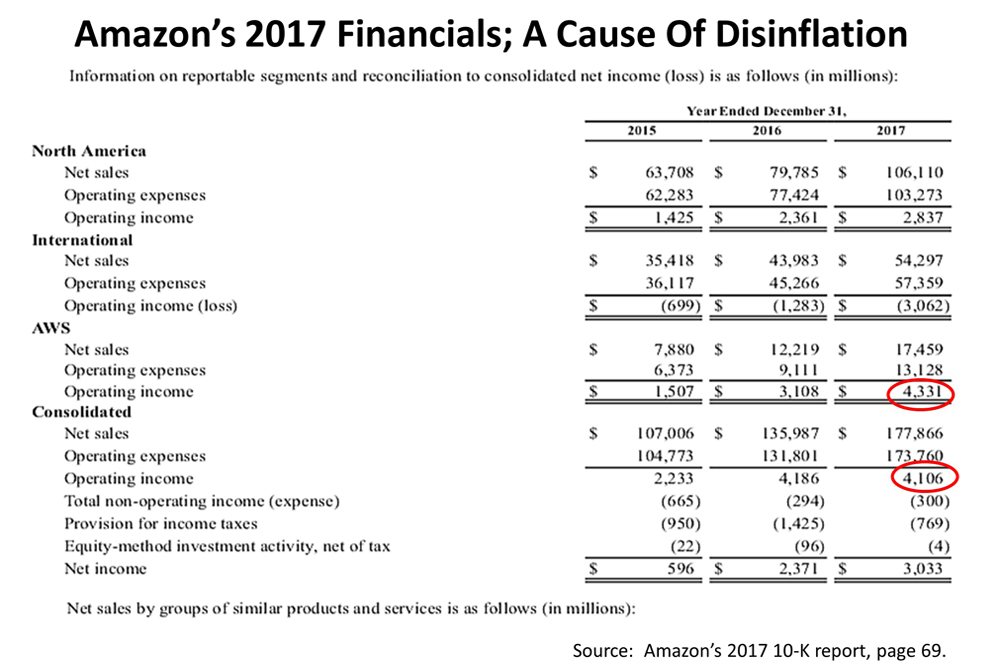

Is Amazon Keeping The Inflation Rate Low?

Is Amazon Keeping The Inflation Rate Low?

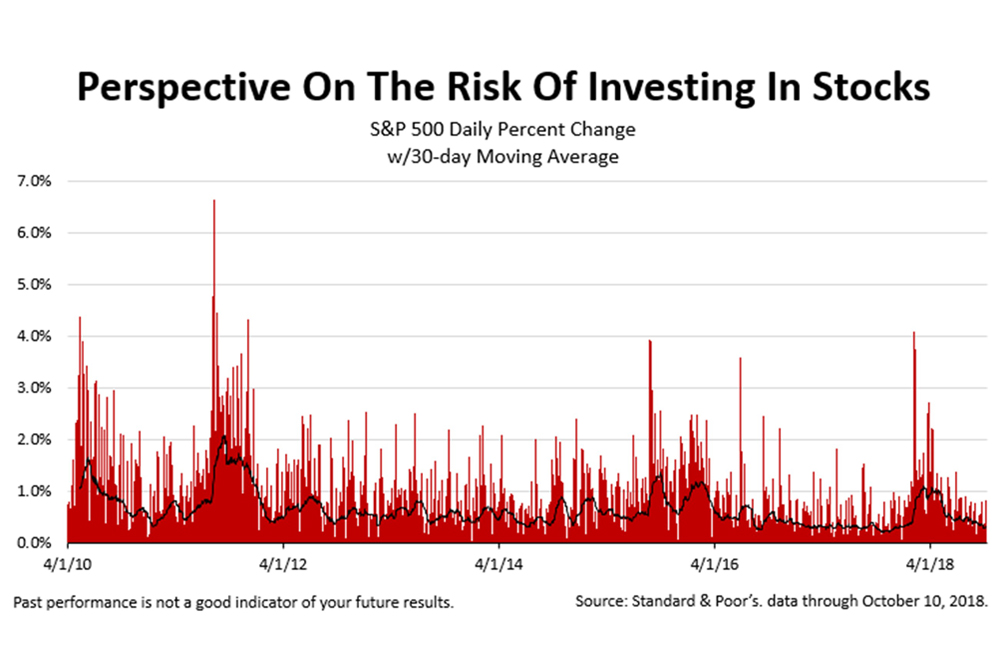

Analyzing The Market Correction

Analyzing The Market Correction

This Week In Stocks And The Economy

This Week In Stocks And The Economy

Analyzing The Risk Of Stocks After The 6.9% Drop

Analyzing The Risk Of Stocks After The 6.9% Drop

Fed Chair: "We Remain In Extraordinary Times."

Fed Chair: "We Remain In Extraordinary Times."

With The S&P 500 Up 7.2% In 3Q18, What's Driving Stocks?

With The S&P 500 Up 7.2% In 3Q18, What's Driving Stocks?

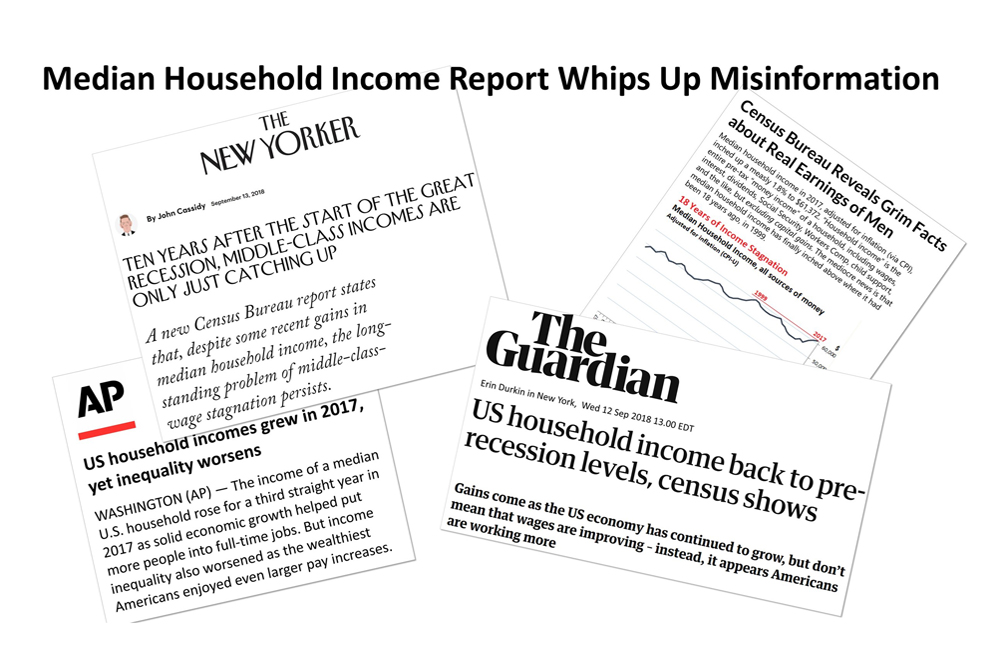

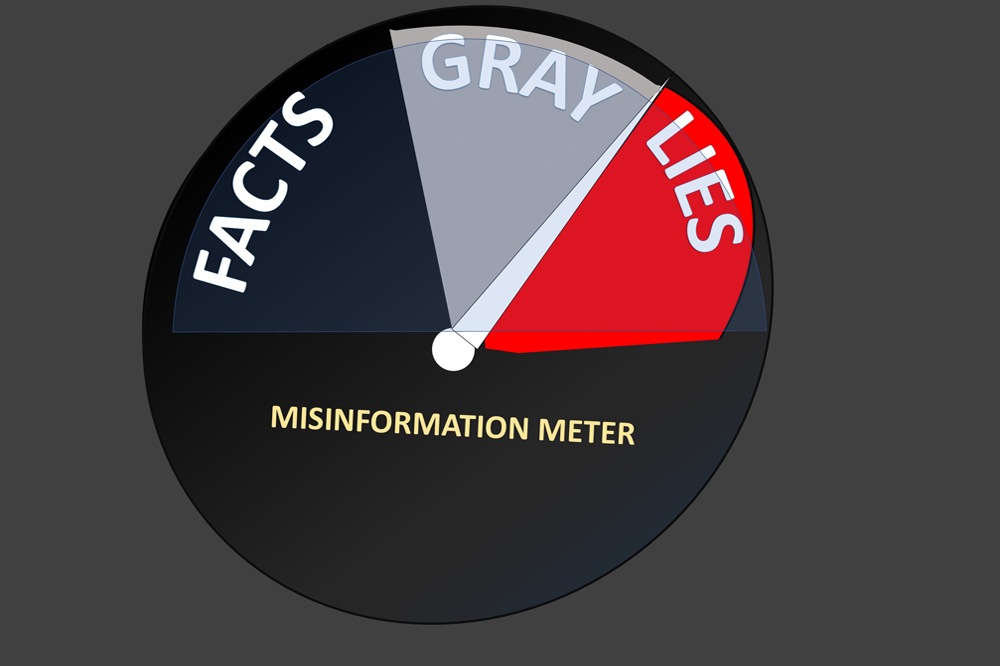

Widespread Misinformation Follows Household Median Income Report

Widespread Misinformation Follows Household Median Income Report

Investment Wisdom At A Poignant Moment In History

Investment Wisdom At A Poignant Moment In History

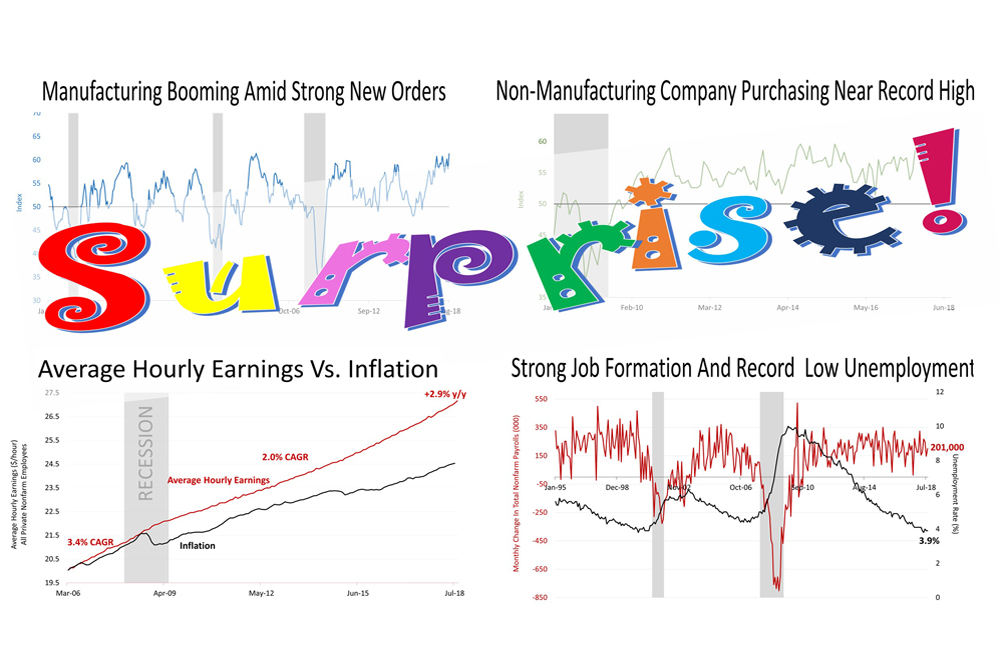

Good Economic Surprises Happening Now

Good Economic Surprises Happening Now

Economic Facts To Prepare For The Elections

Economic Facts To Prepare For The Elections

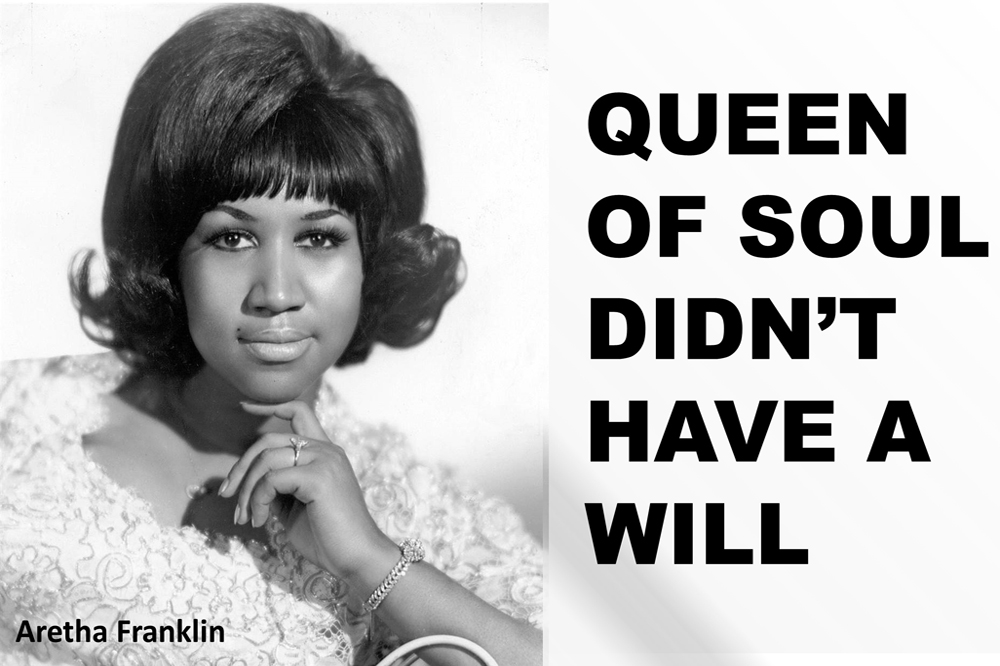

Another Member Of Music Royalty Dies With No Will

Another Member Of Music Royalty Dies With No Will

Top 10 Indications The Economic Outlook Is Brighter Than Expected

Top 10 Indications The Economic Outlook Is Brighter Than Expected

Wealth And Economic News This Week (2-Minute Read)

Wealth And Economic News This Week (2-Minute Read)

10 Things: New Education Tax Breaks For A Child Or Grandchild

10 Things: New Education Tax Breaks For A Child Or Grandchild

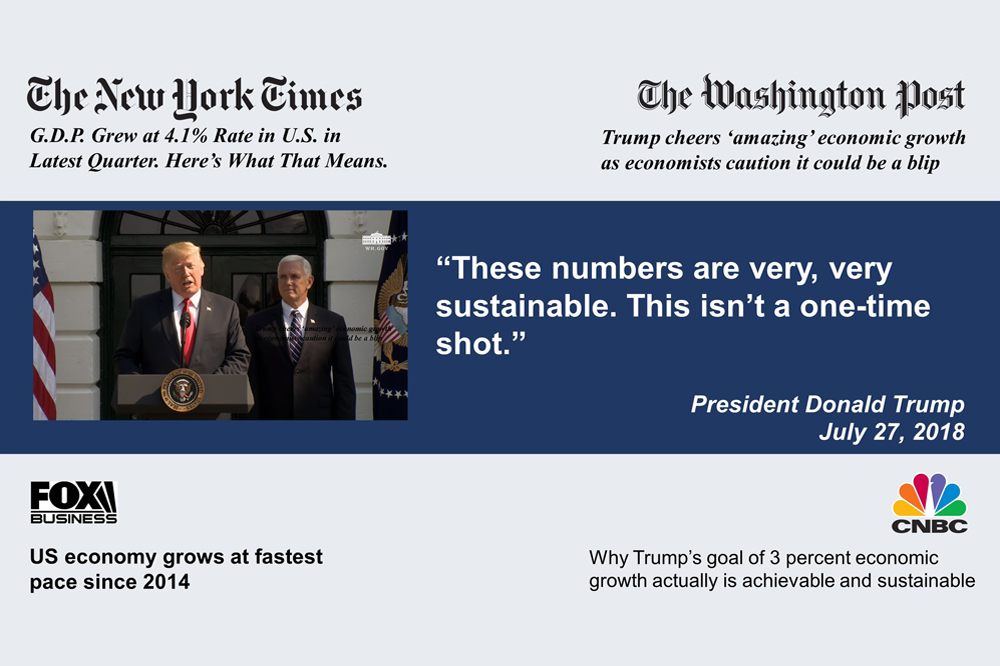

The Truth About U.S. GDP Growth

The Truth About U.S. GDP Growth

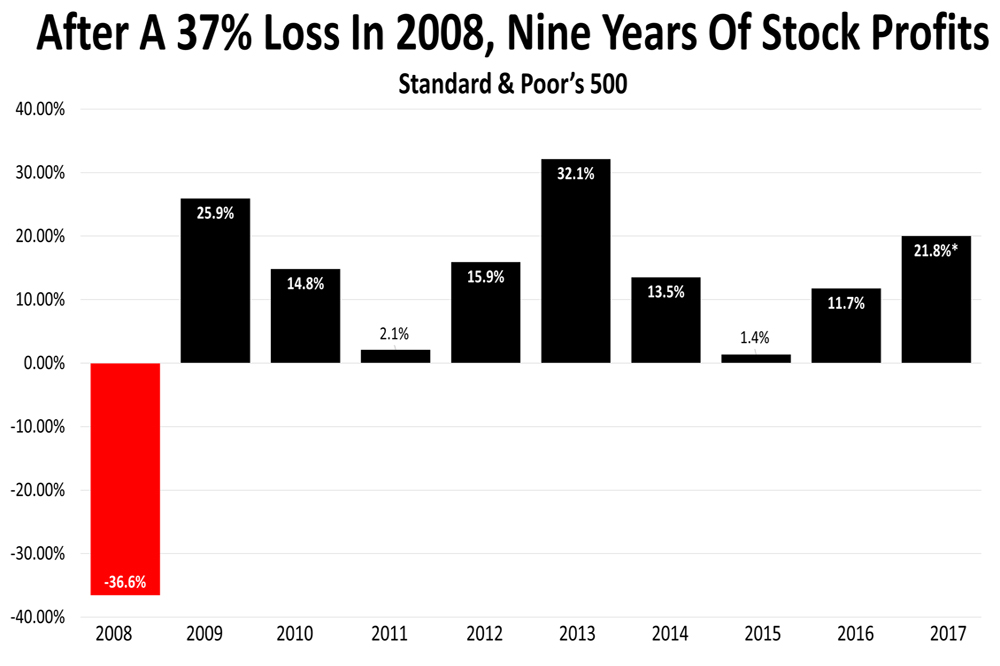

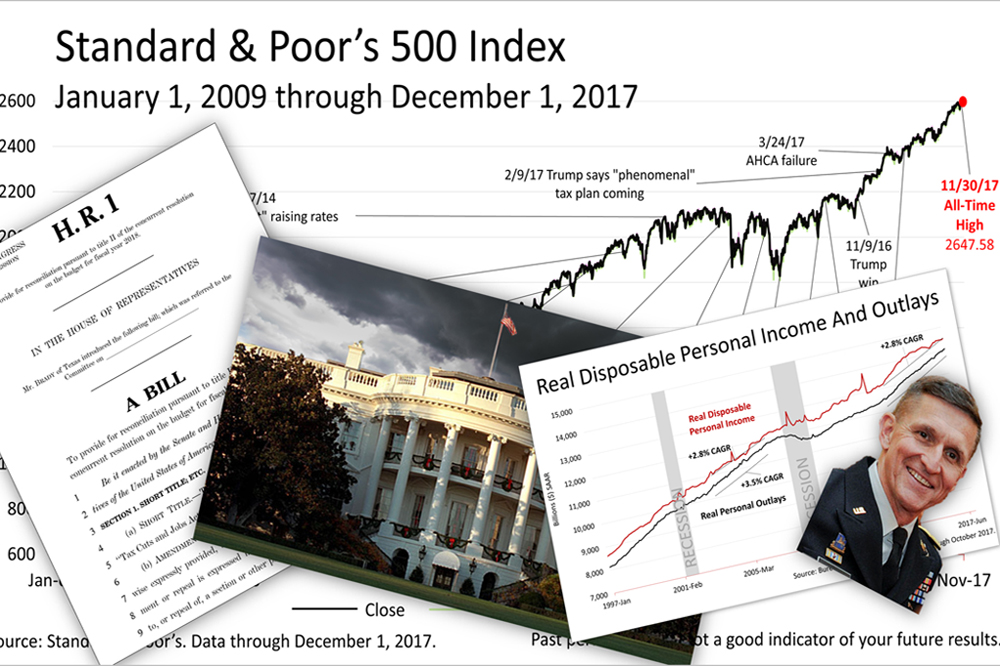

2017 Ends With S&P 500 Total Return Of 21.8%

2017 Ends With S&P 500 Total Return Of 21.8%

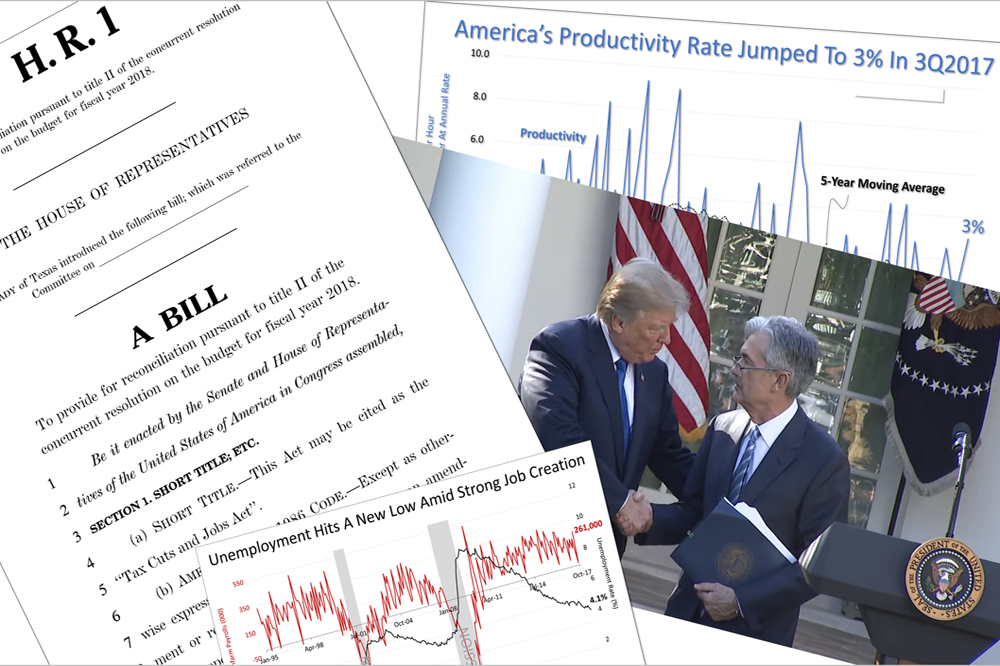

President Signs Historic Tax Cuts And Jobs Act; Stocks Drop A Fraction

President Signs Historic Tax Cuts And Jobs Act; Stocks Drop A Fraction

Good News On The Economy And A Tax Alert

Good News On The Economy And A Tax Alert

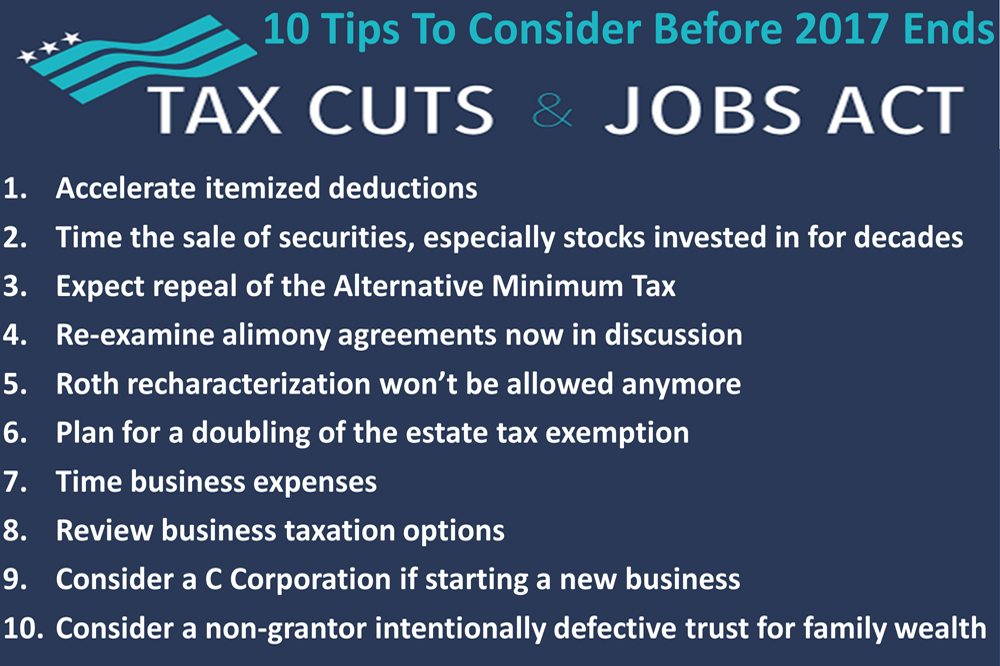

Tax Bill Drives Another Stock Market Record And Gives You To-Dos By Year-End

Tax Bill Drives Another Stock Market Record And Gives You To-Dos By Year-End

An Eventful Week In Wealth Management

An Eventful Week In Wealth Management

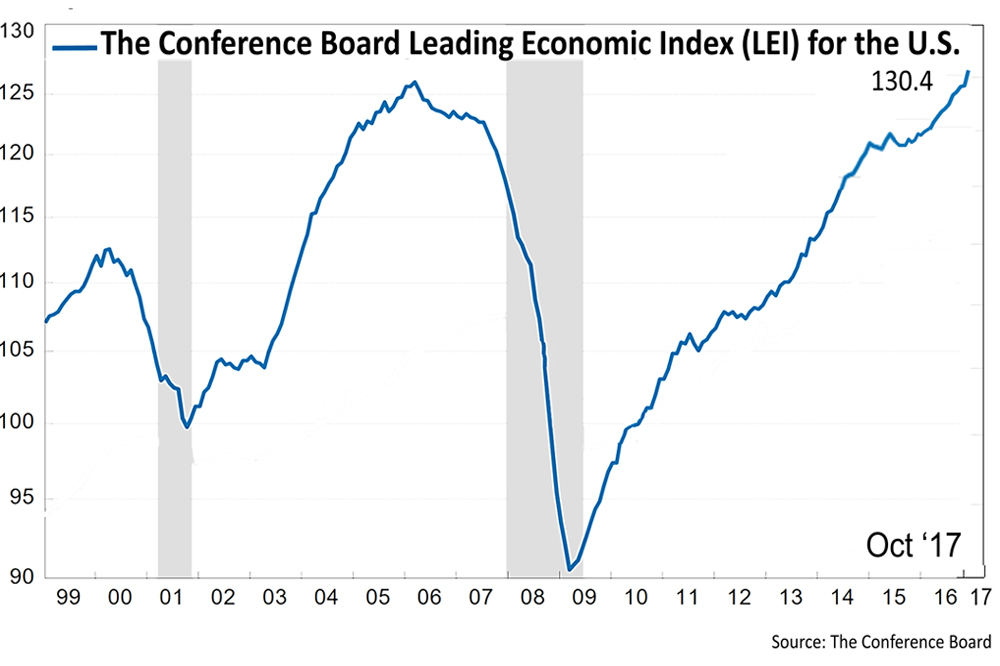

Leading Economic Indicators Surge, Stocks Break Record High Again

Leading Economic Indicators Surge, Stocks Break Record High Again

News Affecting Your Wealth Dominated The Headlines This Past Week

News Affecting Your Wealth Dominated The Headlines This Past Week

U.S. GDP Growth Surprise Propels Stocks To New Record

U.S. GDP Growth Surprise Propels Stocks To New Record

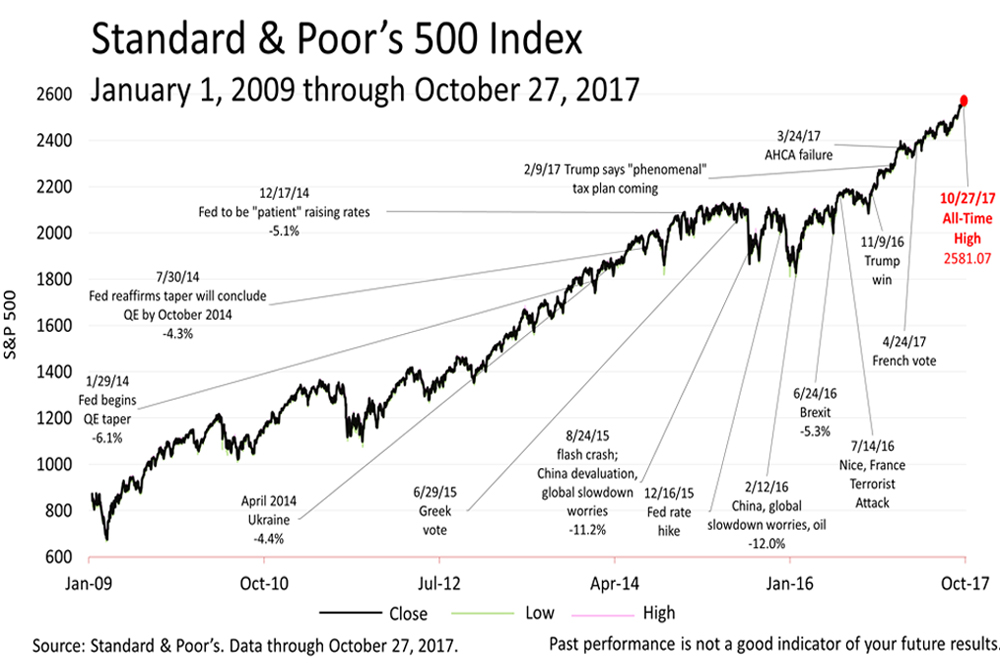

Why Does The S&P 500 Keep Breaking Records?

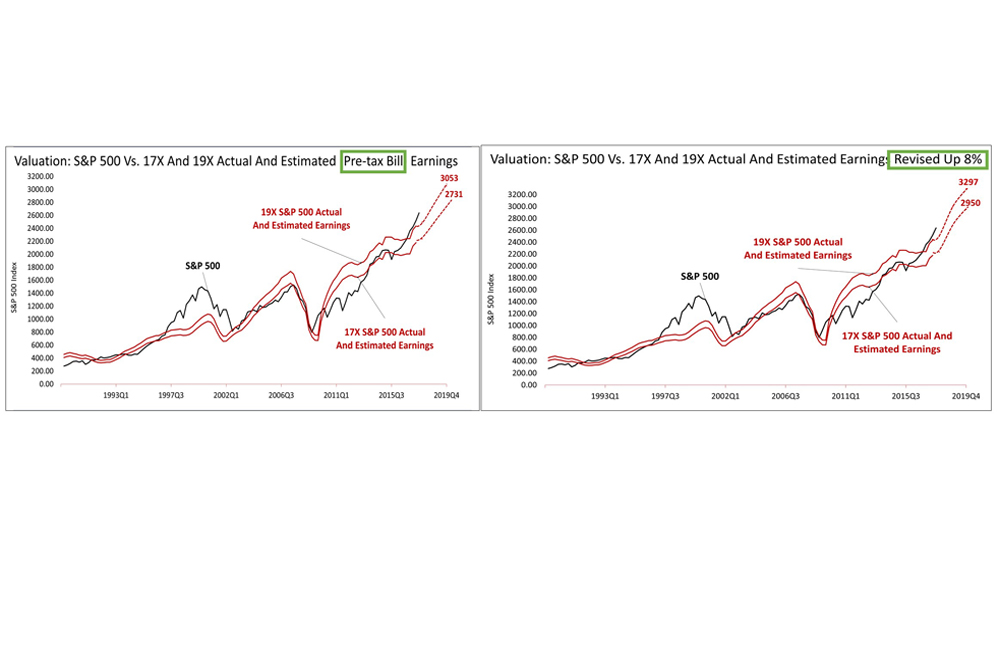

Why Does The S&P 500 Keep Breaking Records?

U.S. Stocks Nearly Doubled In The Last Five Years

U.S. Stocks Nearly Doubled In The Last Five Years

The Big Economic News The Media Keeps Missing

The Big Economic News The Media Keeps Missing

Trump Tax Plan Upends Year-End Tax Planning

Trump Tax Plan Upends Year-End Tax Planning

Key Senators Agree On A Road To Cutting Taxes This Year

Key Senators Agree On A Road To Cutting Taxes This Year

Year-End Tax Planning Could End With A Thrill This Year

Year-End Tax Planning Could End With A Thrill This Year

This Week's News About Wealth Management

This Week's News About Wealth Management

Stocks Dropped For Second Straight Week Amid Strengthening Economic Reports

Stocks Dropped For Second Straight Week Amid Strengthening Economic Reports

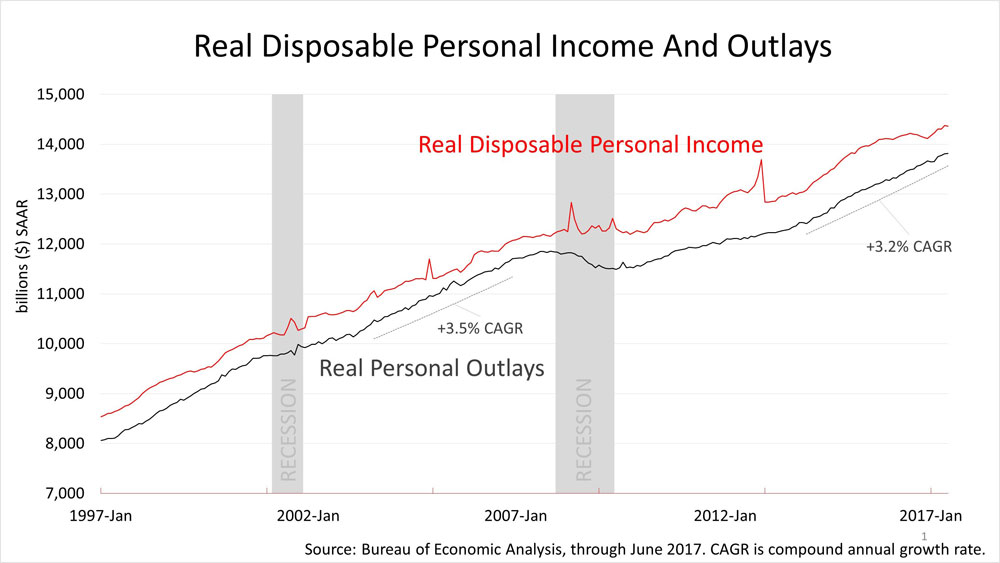

With Stocks Near All-Time High, Personal Income And Employment Data Are Released

With Stocks Near All-Time High, Personal Income And Employment Data Are Released

How Strategic Asset Allocation And Rebalancing Worked In The 12 Months Ended June 30

How Strategic Asset Allocation And Rebalancing Worked In The 12 Months Ended June 30

Wall Street's "Top" Strategists' Recommendations Are Like Monkeys Throwing Darts

Wall Street's "Top" Strategists' Recommendations Are Like Monkeys Throwing Darts

Stronger Than Expected Jobs Creation But CNBC Reports "Trouble Lurked"

Stronger Than Expected Jobs Creation But CNBC Reports "Trouble Lurked"

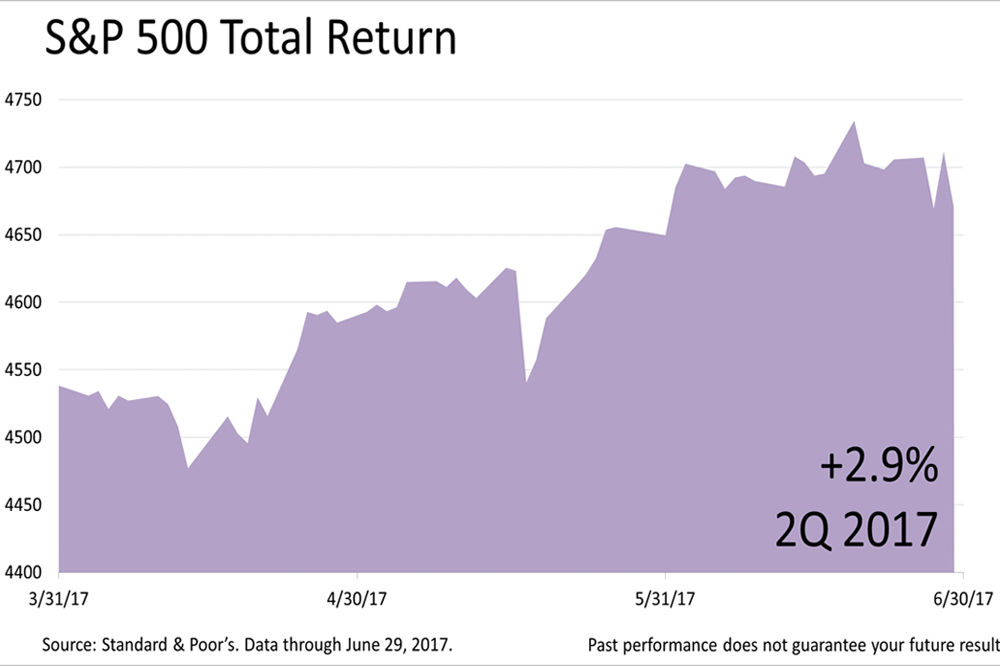

S&P 500 Returned 2.9% In 2nd Quarter And 9.2% In First Half Of 2017

S&P 500 Returned 2.9% In 2nd Quarter And 9.2% In First Half Of 2017

Despite Distractions, Demographics Are Poised To Drive U.S. Long-Term Growth

Despite Distractions, Demographics Are Poised To Drive U.S. Long-Term Growth

The Federal Reserve's Historic Economic Experiment Entered A New Phase

The Federal Reserve's Historic Economic Experiment Entered A New Phase

Despite The Washington Sideshow, Stocks Closed At A New All-Time High

Despite The Washington Sideshow, Stocks Closed At A New All-Time High

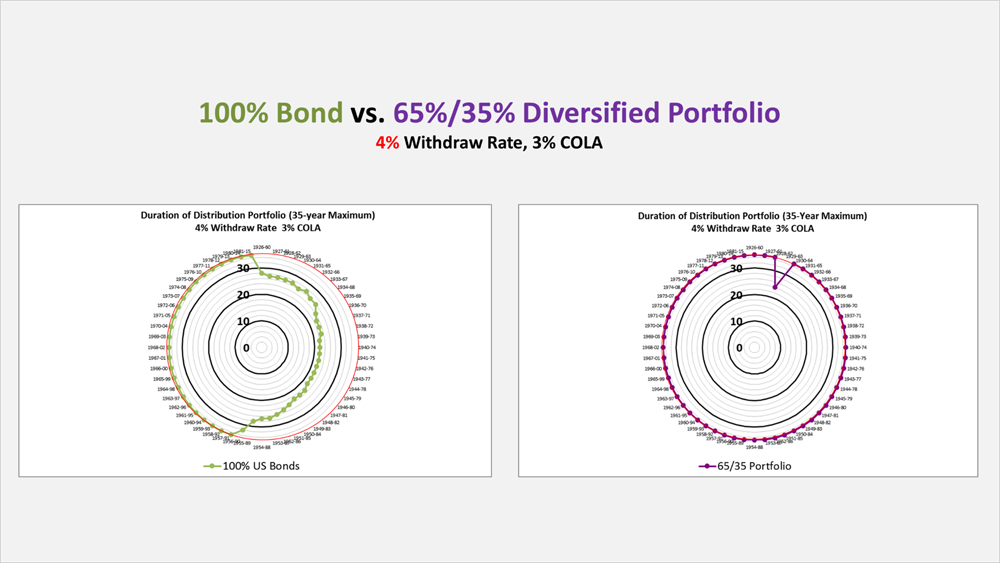

Visualizing The Risk Of Running Out Of Money In Retirement

Visualizing The Risk Of Running Out Of Money In Retirement

Wall Street's Strategists About As Good As Monkeys Throwing Darts

Wall Street's Strategists About As Good As Monkeys Throwing Darts

Stocks Surge 2% Friday But Why Are They So Volatile Lately?

Stocks Surge 2% Friday But Why Are They So Volatile Lately?

Dachtler Wealth Management

2130 East Bidwell Street

Folsom, CA 95630

P: 1-800-333-1855

F: 1-916-933-5639

info@dachtlerwealth.com

Stocks Closed At A Record High

The Standard & Poor’s 500 stock index closed Friday at a new all–time high, ending the first quarter of the year with a gain of 10%. That’s as much as

Slick TV ads often make financial planning and wealth management sound simple, but it’s usually not. Managing wealth requires knowing a lot about highly technical topics, like taxes, government

This is not an offer of securities in any jurisdiction, nor is it specifically directed to a resident of any jurisdiction. As with any security, request a prospectus from your registered representative. Read it carefully before you invest or send money. Securities products are limited to residents of AZ, CA, CO, FL, GA, ID, IL, IN, KS, MA, MO, NC, NE, NM, NV, OR, TN, TX, UT and WA.

Securities and Advisory Services offered through Calton & Associates, Inc. Member FINRA/SIPC. Dachtler Wealth Management, LLC and Calton are not affiliated. www.finra.org, www.sipc.org

A Representative from Dachtler Wealth Management will contact you to provide requested information.

Representatives of Calton & Associates, Inc do not provide tax or legal advice. Please consult your tax advisor or attorney regarding your situation.

CA License # 0658362

This website uses cookies for navigation, content delivery and other functions. By using our website you agree that we can place cookies on your device. I understand